Investing in Monterey County for Over 30 Years

Financial advising for multi-generational wealth

About Andresen & Associates

Originally founded to manage local farmers' and ranchers' money, our firm has grown through two generations of leadership into a modern wealth management firm serving all of Monterey County.

Year Founded: 1987

Specialties: Legacy & Estate Planning, Retirement, Doctors

Fees: 0.1-1% of Assets Under Managment (Depending on Size)

-

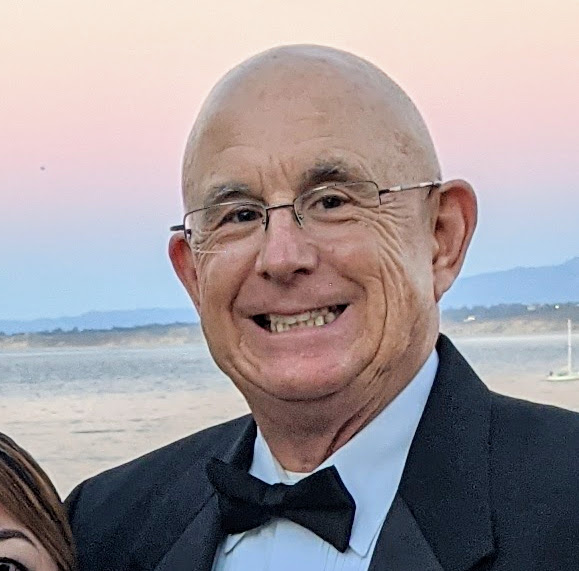

Pete Andresen

Founder / CEO

Eric Andresen

Junior Partner

Karen Andresen

Client Advocate